The gold and silver bullion markets offer significant opportunities for investors seeking diversification, wealth preservation, and long-term returns. As global economic uncertainty continues, these markets remain critical for those looking to hedge against inflation and currency volatility. This article explores the dynamics of gold and silver investments, covering everything from bullion products to price trends and storage solutions.

Why Invest in Gold Bullion?

Gold has historically been a reliable store of value and a hedge against inflation. Its enduring appeal stems from its intrinsic value and universal acceptance. Gold bullion products, such as bars and coins, provide direct ownership, which offers security during times of economic instability.

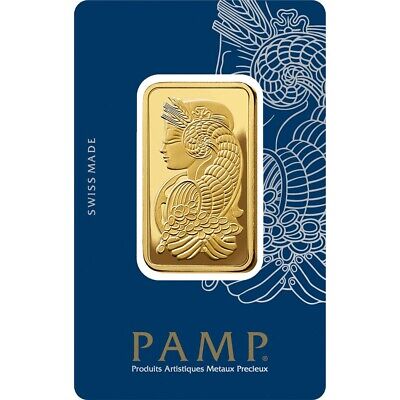

Gold Bars:

Gold bars are ideal for large-scale investors. Articles from Stockhouse highlight the importance of understanding weight and purity when investing in gold bars, as these factors influence liquidity and resale value. Bars are available in sizes ranging from 1 gram to 1 kilogram, with 1-ounce bars being particularly popular for their balance of affordability and market demand.

Fractional Gold Coins:

For smaller investments, fractional gold coins like the 1/10 oz coins offer flexibility. These coins are accessible to a wider audience, allowing investors to buy gold incrementally while maintaining liquidity.

Understanding Purity and Weight:

As noted by DRG Blog, gold purity is a critical consideration. Most investment-grade gold products feature .999 or .9999 purity. These high-purity products are preferred for their ease of valuation and recognition in the market.

Silver Bullion: A Versatile Investment Option

Silver complements gold as a precious metal investment, offering affordability and industrial demand. Its dual role as a monetary and industrial asset enhances its appeal.

Silver Prices and Market Trends:

According to Barchart, silver prices are influenced by macroeconomic factors and industrial demand. Recent trends suggest a growing emphasis on silver’s use in renewable energy technologies, such as solar panels, which could drive future demand.

Silver Bullion Coins:

Silver coins are a popular entry point for investors. Articles from Newsbreak and Medium highlight the with benefits of coins like American Silver Eagles and Canadian Silver Maples. These government-backed coins are easy to trade and widely recognized.

Calculating Silver Melt Value:

A practical tool for silver investors is the melt value calculator. This tool helps investors determine the intrinsic value of their silver holdings based on current market prices and metal content.

Storage and Security for Precious Metals

Proper storage is essential to preserve the value of gold and silver bullion. Experts emphasize the importance of climate-controlled environments and secure facilities to prevent damage or theft.

Home Storage vs. Professional Vaults:

While storing bullion at home offers immediate access, it comes with risks like theft and environmental damage. Professional storage facilities provide insurance, security, and climate control, ensuring long-term preservation.

Safe Handling Practices:

When handling precious metals, use gloves to avoid tarnishing and store them in individual holders or tubes. These precautions are critical for maintaining the resale value of your bullion.

Gold and Silver in the Current Economic Climate

The gold and silver markets are significantly influenced by global economic conditions. Recent insights indicate that central bank gold purchases reached historic highs in 2024, signaling strong central bank and institutional demand.

Gold-Silver Ratio:

The gold-silver ratio is a key metric for evaluating relative value. A higher ratio suggests silver is undervalued compared to gold, presenting potential buying opportunities for silver investors.

Future Outlook:

Both metals are expected to remain pivotal in diversified portfolios. Gold’s stability and silver’s industrial applications create a complementary investment strategy that mitigates risks associated with traditional financial assets.

The Role of Retailers in the Bullion Market

Where you buy precious metals matters. Reputable retailers offer guarantees of authenticity and quality. Insights highlight the pros and cons of buying from unconventional sources like Costco. While convenient, traditional dealers and mints often provide better pricing and selection.

Trusted Retailers:

Look for dealers accredited by the London Bullion Market Association (LBMA) or those offering buyback programs. These features ensure liquidity and long-term investment value.

Conclusion

Investing in gold and silver bullion offers a secure and versatile way to preserve wealth. By understanding market dynamics, selecting high-quality products, and employing proper storage solutions, investors can navigate the precious metals market confidently. For more detailed guidance, refer to the resources linked throughout this article.

References:

- Crucial Insights for 2024 Investors: The Importance of Silver Prices

- Investing in Gold Bars

- Collecting Roosevelt Silver Dimes

- Understanding the Purity and Weight of Gold Bullion Products

- Costco Gold Bar Investment Tips

- The Benefits of Investing in 1/10 oz Gold Coins

- Understanding and Using a Silver Coin Melt Value Calculator

- How to Properly Store and Protect Your Valuable Coins

- Understanding Silver Bullion Coins

- Gold Price Today and Future Predictions