Gold has been the ultimate store of value for thousands of years, used as currency, wealth preservation, and financial security. Unlike paper money, which governments can devalue through inflation or policy changes, gold remains a tangible, universally recognized asset. However, investing in gold comes with unique legal quirks and historical precedents that every investor should understand.

From government bans on private gold ownership to tax exemptions for rare coins, the legal landscape of gold investing has been shaped by history, economic crises, and regulatory policies. These strange rules aren’t just historical footnotes—they offer key insights into protecting wealth and making smarter investment decisions today.

Rule #1: The Gold Confiscation of 1933—And Its Collectors’ Loophole

In 1933, President Franklin D. Roosevelt issued Executive Order 6102, banning private ownership of gold in the U.S. The government required citizens to turn in their gold coins, bars, and certificates to the Federal Reserve in exchange for paper money. This policy was designed to combat deflation during the Great Depression, but in effect, it confiscated private wealth.

However, there was one crucial exception:

- Rare and collectible gold coins were exempt from the ban.

- This meant numismatists and collectors could legally hold onto their gold, even as the general public was forced to surrender theirs.

How Investors Can Use This Rule Today:

While gold ownership is now fully legal, this historical precedent highlights why rare gold coins remain a strategic investment:

✅ Legal protection – Government restrictions on bullion could return, but rare coins may still be exempt.

✅ Numismatic premiums – Unlike bullion, rare coins are appreciated based on scarcity and collector demand, not just gold content.

✅ Portfolio diversification – Holding a mix of bullion and rare coins can hedge against economic uncertainty.

Rule #2: The 1933 Double Eagle—The Gold Coin You Can’t Own

Not all gold coins are fair game for investors. The 1933 Saint-Gaudens Double Eagle is among the rarest and most controversial U.S. gold coins ever minted.

- Produced initially as $20 gold coins, the entire mintage was ordered to be melted down due to the 1933 gold ban.

- A handful survived—illegally—and the U.S. government considers them property of the Treasury.

- In 2002, one of these coins was sold at auction for $7.6 million—but only after the buyer paid an extra $20 to officially “monetize” it under U.S. law.

How Investors Can Use This Rule Today:

🚨 Be cautious when purchasing ultra-rare coins—some may be government-seized property.

📜 Verify provenance – Ensure collectible gold coins have legal, documented ownership before buying.

💰 Consider legal numismatic alternatives – Coins like pre-1933 U.S. gold coins remain legal to own and trade.

Rule #3: Large Gold Transactions Must Be Reported

Many investors assume buying and selling gold is a private transaction, but the IRS requires reporting for large transactions:

- Any gold sale or purchase exceeding $10,000 must be reported to the IRS under anti-money laundering laws.

- Dealers may also need to report cash transactions over $10,000 under the Bank Secrecy Act.

- Certain gold coins, bars, and bullion transactions may trigger Form 1099-B reporting requirements.

How Investors Can Use This Rule Today:

🔎 Understand tax implications – Gold is taxed as a collectible asset, meaning higher capital gains tax rates (up to 28%).

💡 Use strategic selling – Instead of one large sale, consider selling smaller amounts over time to minimize reporting requirements.

📑 Keep transaction records – Maintain receipts and purchase history for tax reporting and potential resale.

Rule #4: Importing Gold Comes with Customs Duties

If you bring gold into the U.S., it may be subject to a 3.9% customs duty. However, there are exceptions:

- Gold bullion bars typically require import duties, depending on origin and purity.

- Legal tender gold coins (e.g., American Eagles, Canadian Maple Leafs) are often duty-free.

- If carrying more than $10,000 worth of gold, you must declare it to U.S. Customs.

How Investors Can Use This Rule Today:

🌍 Buy domestically when possible – Avoid import duties by purchasing from U.S.-based dealers.

🏛 Understand international tax laws – If investing in foreign gold markets, research import/export regulations.

🛂 Declare gold at customs – Failure to report extensive gold holdings can result in confiscation.

Rule #5: Gold IRAs and the Tax-Free Advantage

Did you know you can hold physical gold in a retirement account? The IRS allows certain gold coins and bars to be held in a self-directed IRA (Gold IRA).

- However, not all gold is eligible—it must meet IRS purity requirements:

- ✅ American Gold Eagle coins

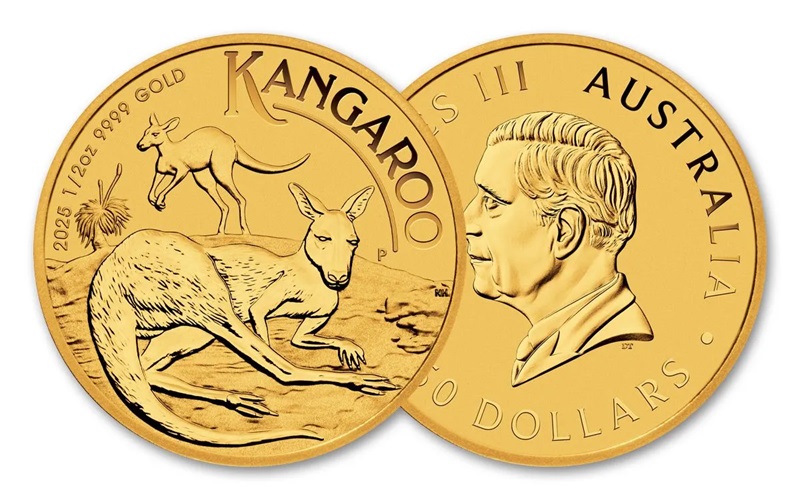

- ✅ Canadian Gold Maple Leafs

- ✅ Gold bars of 99.5% purity or higher

- The gold must be stored in an approved depository—you cannot keep it at home.

How Investors Can Use This Rule Today:

🏦 Tax advantages – Gold IRAs offer tax-deferred growth, meaning no capital gains taxes until withdrawal.

💰 Diversify retirement savings – Gold can hedge against inflation and market crashes in an IRA.

📜 Follow IRS guidelines – Work with a reputable Gold IRA custodian to ensure compliance.

Conclusion: Know the Rules, Maximize Your Gold Investment

Gold has been money for over 5,000 years, but investing in it requires understanding the legal landscape. From historic gold confiscations to modern reporting rules, these laws shape how investors buy, sell, and store gold today.

The key takeaways for savvy gold investors:

✅ Diversify holdings – Own bullion and rare coins for security and numismatic value.

✅ Be mindful of taxes – Large transactions may be reportable to the IRS, and gold is taxed as a collectible.

✅ Use Gold IRAs for tax benefits – Holding gold in an IRA can reduce tax burdens and build long-term wealth.

✅ Buy from reputable dealers – Avoid legal pitfalls by ensuring provenance and authenticity.

Leveraging these strange but important gold investing rules allows investors to maximize returns while minimizing legal and tax risks.

Reference Links:

- U.S. Treasury – Gold Confiscation & Executive Order 6102 – https://www.treasury.gov/resource-center/faqs/currency/pages/edu_faq_currency_legaltender.aspx

- IRS Reporting Requirements for Gold Transactions – https://www.irs.gov/businesses/small-businesses-self-employed/reporting-cash-payments-over-10000

- U.S. Mint – List of Legal Gold Coins for Investment – https://www.usmint.gov/learn/coin-and-medal-programs/bullion-program

- U.S. Customs – Gold Import Regulations – https://www.cbp.gov/travel/international-visitors/kbyg/customs-duty-info

- IRS – Gold IRA Rules and Regulations – https://www.irs.gov/retirement-plans/retirement-topics-iras

Final Thought: Investing in Gold the Smart Way

By understanding the strange legal rules of gold investing, investors can protect their wealth, navigate regulations, and use gold’s historical value to their advantage. Whether buying bullion, collecting rare coins, or investing through an IRA, gold remains one of human history’s most reliable long-term stores of value.