Gold has been regarded as a valuable asset for centuries and is a popular investment choice today. It offers a hedge against inflation, currency devaluation, and economic uncertainties. This article explores various options for investing in gold, providing insights into their potential benefits and drawbacks.

Physical Gold

Investing in physical gold involves purchasing tangible gold products such as coins, bars, or jewelry. This option provides security by owning tangible, physical assets.

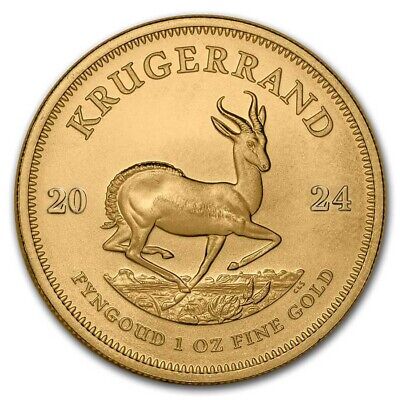

- Gold Coins: Coins like the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand are popular among collectors and investors. They offer liquidity and can be quickly sold in the market. Learn more about American Gold Eagle coins.

- Gold Bars: Gold bars come in various sizes, offering different levels of investment. They typically have lower premiums over the spot price compared to coins. Explore London Bullion Market Association guidelines for gold bars.

- Gold Jewelry: Gold jewelry can hold intrinsic value but is not considered an investment. However, it often carries a higher markup and may not offer the same liquidity as coins or bars.

Gold Exchange-Traded Funds (ETFs)

Gold ETFs provide an alternative to owning physical gold. They are traded on stock exchanges and track the price of gold, offering investors exposure to gold without needing physical storage.

- SPDR Gold Shares (GLD): This is one of the largest and most famous gold ETFs, offering investors a cost-effective way to gain exposure to gold prices.

- iShares Gold Trust (IAU): Another well-known gold ETF that offers a lower expense ratio compared to some alternatives.

Gold Mining Stocks

Investing in gold mining stocks involves purchasing shares of companies engaged in extracting and producing gold. This option can leverage gold prices, as mining companies’ profits may increase with rising gold prices.

- Newmont Corporation: As one of the largest gold mining companies globally, Newmont offers stability and potential for growth.

- Barrick Gold Corporation: Known for its global operations, Barrick Gold provides exposure to diverse mining activities.

Gold Futures and Options

For those with higher risk tolerance and experience in financial markets, gold futures and options provide opportunities to speculate on the future price of gold. These derivatives allow investors to leverage their positions and achieve higher returns.

- Gold Futures: A contract to buy or sell gold at a predetermined price at a specified time.

- Gold Options: Provides the right, but not the obligation, to buy or sell gold at a set price before the expiration date.

Conclusion

Gold remains a viable investment option for diversifying their portfolio and protecting against economic uncertainties. Each option offers unique benefits and risks, whether through physical gold, ETFs, mining stocks, or derivatives. Investors should carefully consider their investment goals and risk tolerance when investing in gold.

For further reading, you may refer to the following resources:

Leave a Reply