Hook: If your bank just notified you that your safe deposit box is being closed—or you can’t find one to rent—you’re not alone. Large institutions have been phasing out safe deposit services and trimming branches, leaving collectors scrambling for secure, insured storage. Meanwhile, crime trends and insurance fine print can turn a moment’s lapse into a five-figure loss. Here’s a decisive plan to protect your coin collection in 2025 with professional rigor and practical steps.

Why This Matters Now: The Storage Landscape Has Changed

Over the last few years, big banks have steadily reduced safe deposit box availability. JPMorgan Chase has stopped offering new boxes and is closing existing ones as part of a strategic shift; even the Wall Street Journal has reported on the long, gradual decline of safe deposit boxes nationwide.

At the same time, the branch footprint keeps shrinking as digital banking becomes the norm. In 2024, US banks closed thousands of branches, continuing a multi-year trend; researchers have documented persistent declines since at least 2019. Fewer branches often means fewer vault services for consumers.

One more crucial point: the contents of bank safe deposit boxes are not insured by the FDIC. If you store rare coins there, you need your own coverage. The FDIC states this clearly.

From a risk perspective, property crime broadly declined in 2024, yet losses can be devastating and highly localized. The FBI’s 2024 data show property crimes fell 8% year-over-year—but that’s cold comfort if your collection is the outlier.

“I learned the hard way that being ‘low-key’ and insured matters as much as what you collect.” — Jeff Garrett, veteran dealer and former ANA president, reflecting on a burglary and the lessons that followed.

TL;DR (Quick Wins)

- Confirm insurance now. Homeowner’s policies often cap collectibles; add a rider or specialized policy.

- Choose storage deliberately. Compare safe deposit boxes, home TL-rated safes, and professional depositories.

- Ship like a pro. For valuable coins, USPS Registered Mail is the industry standard—check current limits.

- Keep a tight profile. Limit who knows what you own and where it’s stored. (Best practice from industry pros.)

The Insurance Reality: What Your Policy Likely Doesn’t Cover

Many collectors assume homeowner’s coverage will make them whole after a theft or fire. In practice, standard policies impose special sub-limits on high-value categories (jewelry, coins, art), and those caps can be startlingly low without a rider (“scheduled personal property” or “personal articles floater”). The National Association of Insurance Commissioners specifically recommends scheduling items like coins to avoid sub-limits.

Industry guides from the Insurance Information Institute and others echo that message: expect limits and exclusions unless you add dedicated coverage. In plain terms, if you’ve built a serious collection, you probably need a rider or a standalone collectibles policy to insure it properly.

Pro tip for numismatists: The American Numismatic Association works with specialist brokers who understand coin risks (e.g., inland marine, in-transit coverage, show coverage). If you’re shopping policies, ask about worldwide coverage, mysterious disappearance, and whether the policy pays agreed value (or market value at time of loss).

Insurance Checklist (Do This This Week)

- Read your declarations page: identify sub-limits affecting coins, bullion, cash, or collectibles.

- Schedule high-value coins (certified with PCGS/NGC/CAC where applicable) and attach appraisal documents.

- Confirm in-transit coverage for shows, trades, and submissions to graders.

- Verify off-premises coverage (storage unit, bank, depository).

- Ask about deductibles, exclusions, and claims process timelines.

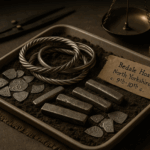

Storage Options Compared: Pros, Cons, and Insurance Considerations

H2: Protect Your Coin Collection with the Right Storage Mix

| Option | Pros | Cons | Insurance Notes |

|---|---|---|---|

| Bank Safe Deposit Box | Hardened vaults; off-site risk diversification; often affordable rent | Scarce/closing; limited access hours; not FDIC-insured; bank disclaimers | You need your own rider or collectibles policy; read the rental agreement carefully. |

| Home Safe (TL-rated) | Immediate access; control over environment; can be discreetly installed | Physical attack and fire risk if under-spec’d; must be bolted and hidden | Choose UL 687 burglary ratings (TL-15/TL-30+) and UL 72 fire ratings (Class 350 1–2 hr) to protect paper holders & documents. |

| Private Vault Companies | Extended hours; modern facilities; often more flexible than banks | Not banks; varied regulation; still no FDIC; due diligence required | Confirm operator’s insurance, contract terms, and audit practices. Cite their policies in your insurer’s records. |

| Professional Depositories (e.g., Delaware Depository, Brink’s) | Institutional-grade security; audited; explicit all-riskinsurance; IRA-compatible | Recurring fees; access by appointment; primarily ideal for bullion and certified coins | Delaware Depository maintains $1B all-riskcoverage; ask about segregated vs. non-segregated storage. |

Expert take: For substantial collections, a hybrid approach—depository for bulk/bullion, bank box or TL-rated home safe for selected pieces—strikes the best balance of access, security, and insurance verifiability.

The Hardware: What “TL-15/TL-30” and “UL 72” Mean (and Why You Care)

If you install a home safe, the label matters. UL 687 burglary-resistant ratings (e.g., TL-15, TL-30, TL-30×6, TRTL-30×6) indicate a safe has passed standardized tool and/or torch attack tests for a specified duration. Fire labels under UL 72 (e.g., Class 350 1-hour or 2-hour) certify that the interior won’t exceed temperatures that damage paper records and holders during a fire. Choose both a burglary rating and a fire rating that match your risk.

Installation tips: Bolt the safe to a reinforced slab, hide it from casual view, keep humidity controlled (~30–50%), and avoid predictable locations (garage, master closet). Your insurer may reward documented risk mitigation with better rates.

When You Ship: Do It the Way Pros Do

Grading submissions, trades, and consignments are part of the hobby. For higher-value packages, the industry standard is USPS Registered Mail—slow but highly secure, with chain-of-custody handling. Always confirm current insurance limits and exclusions for coins; policies and caps can change. PCGS itself instructs submitters on Registered Mail packaging, and USPS provides the governing rules in its Postal Bulletins and DMM updates.

Shipping playbook

- Double-box; no rattles; paper-tape all seams (Registered requires it).

- Avoid numismatic signals on the label.

- Photograph contents and labels before sealing.

- Keep receipts, tracking, and value documentation for claims.

- For very high values or time-sensitive shipments, discuss third-party transit coverage with your broker.

Behavior Is Part of Security

Burglars favor speed and predictability. Even as national property crimes fell in 2024, opportunistic theft persists—your goal is to be the hardest, least interesting target. Keep your profile low (no coin talk at the delivery door; limit social posts), control mail visibility (use a P.O. box for hobby magazines), and rotate routines. These are the exact habits veteran dealer Jeff Garrett recommends after experiencing a burglarized office.

H2: Protect Your Coin Collection with Documentation and Process

A policy is only as good as your paperwork. Create an audit-ready inventory:

- Catalog: date, mint, grade (PCGS/NGC/CAC), cert numbers, purchase price, current FMV.

- Images: clear obverse/reverse photos; save grading cert images.

- Evidence: invoices, auction lot pages, emails.

- Backups: encrypted cloud + off-site physical backup.

- Appraisals: update periodically for scheduled items (especially after market run-ups).

For bullion and large sets, professional depositories provide additional legal clarity and all-risk coverage—e.g., Delaware Depository cites $1 billion in coverage and UCC protections distinguishing customer property from company assets. Keep copies of those depository terms with your insurance file.

Safe Deposit Boxes: Still Useful—With Caveats

Despite declining availability, a bank box remains useful for documents and select holdings. Just remember the three big caveats:

- No FDIC coverage—you must insure contents yourself.

- Access is limited to banking hours; plan around travel and estate needs.

- Boxes are changing—many institutions are exiting the service; monitor notices and have a relocation plan.

Balanced Perspective: Costs, Risks, and Practical Choices

Pros of depository storage: institutional security, audits, explicit all-risk insurance, IRA compatibility. Cons: recurring fees, logistics, reduced immediacy.

Pros of a home TL-safe: immediate access, control, privacy. Cons: you’re responsible for installation quality, concealment, environmental control, and ensuring your policy truly covers on-premises risks.

Pros of a bank box: hardened vault environment and moderate cost. Cons: declining availability, no FDIC insurance on contents, limited hours.

For most serious collections, a layered strategy wins: depository for value-dense or IRA metals, a bank box for documents/selected pieces, and an appropriately rated and well-installed home safe for items you need to access and enjoy.

Case Study (2025): Why Documentation + Coverage Save the Day

A West Coast collector divided a mid-six-figure collection across a depository, a bank box, and a home TL-30 safe. A pipe burst damaged the room housing the safe; the coins remained intact, and the scheduled personal property rider covered cabinet restoration and professional conservation for two affected holders. The depository portion was unaffected and fully insured under its own all-risk policy. The key? Redundant storage, scheduled coverage, and meticulous inventory. (This is a composite illustrative example informed by standard policy language and depository practices.)

Frequently Asked Questions

Q1: Do I really need special insurance for coins if I have homeowner’s coverage?

Usually, yes. Standard policies often cap categories like coins; adding a scheduled personal property endorsement (or a dedicated collectibles policy) avoids sub-limits.

Q2: Are safe deposit boxes insured by the FDIC?

No. The FDIC insures deposits, not box contents. If you use a bank box, insure the contents separately.

Q3: What safe ratings should I look for at home?

For burglary resistance, look for UL 687 ratings like TL-15 or TL-30; for fire, UL 72 (e.g., Class 350 1–2 hours) protects paper documents and holders.

Q4: What’s the safest way to ship coins?

For higher values, USPS Registered Mail remains the gold standard. Follow PCGS packaging guidance and verify current insurance limits/exclusions before you ship.

Q5: Are private vaults or depositories better than bank boxes?

They’re different tools. Depositories offer institutional security and explicit insurance (e.g., Delaware Depository cites $1B all-risk), but cost more and require logistics. Bank boxes are cost-effective but scarce and uninsured.

Conclusion: Make Your Loss-Prevention Plan Boring—and Bulletproof

The collectors who sleep best checked three boxes: (1) insurance that actually matches their risk, (2) storage that’s deliberate and documented, and (3) habits that don’t advertise valuables. In 2025, as banks retreat from safe deposit boxes and criminals still look for easy wins (even amid lower overall property crime), the professional move is a layered approach: schedule your pieces, pick the right TL-rated and UL 72-rated safe at home, maintain an off-site option, and use Registered Mail for big shipments.

If you haven’t reviewed your setup in the last 12 months, do it now. A two-hour audit this week could prevent a six-figure regret later.